Idaho Child Tax Credit Worksheet 2020

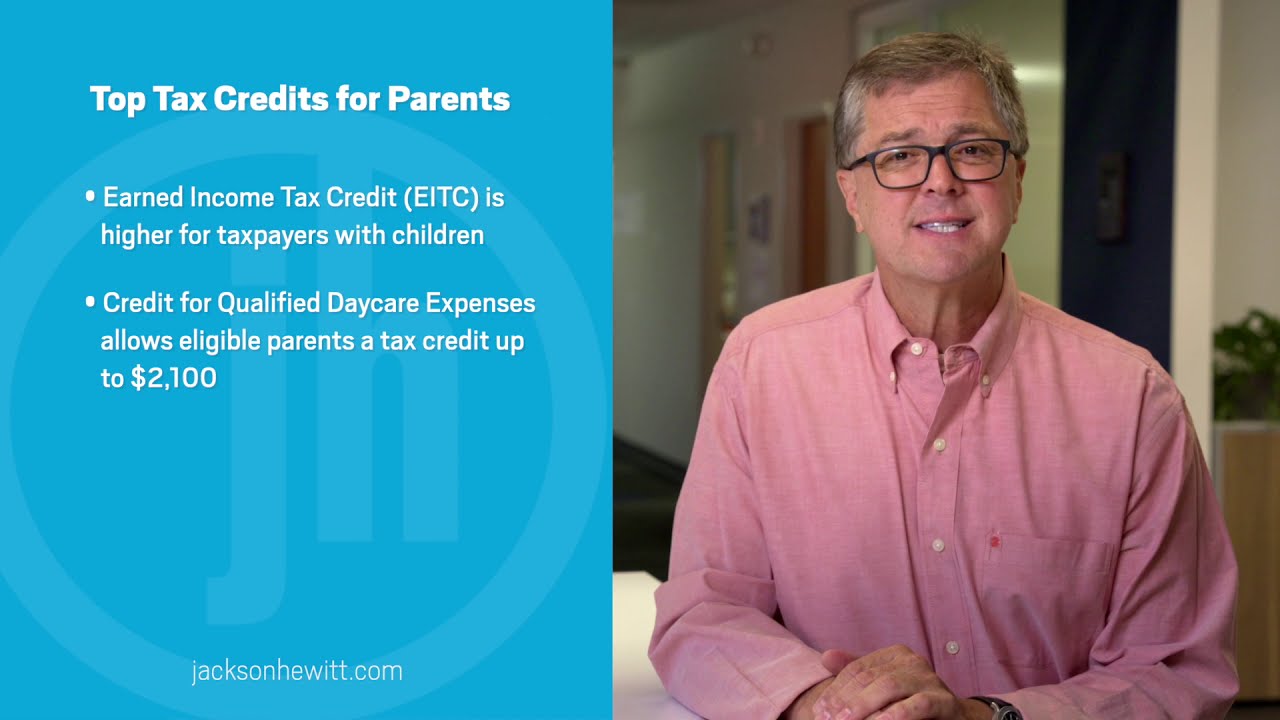

Child tax credit payments will be automatic for those who filed their 2020 tax returns or claimed all their dependents on their 2019 tax return. The credit is 20 of the employers total contribution up to a maximum of 500 per employee each year.

Golden State Stimulus California Earned Income Tax Credit

Miscellaneous business income tax changes have been adopted see Conformity Page for details.

Idaho child tax credit worksheet 2020. Use this worksheet to determine which form to use to claim your credit refund. Complete lines 56 and. Working sheet for tax credits relief on Gift Aid donations pension contributions and trading losses TC825 PDF 515KB 4 pages This file may not be suitable for users of assistive technology.

The corporate income tax rate has been reduced by 0475. If line 26 is more than line 21 enter zero. Any Idahoan who was a full-year resident in 2019 and 2020 and who also filed an Idaho individual income tax return or a grocery credit refund return for 2019 and 2020 is eligible for the rebate.

Anyone with income of 72000 or less can file their federal tax return electronically for. The Child Tax Credit is worth as much as 2000 for the 2020 tax year and up to 1400 of that can be refundable. IN RESPONSE TO THE COVID-19 PANDEMIC THE MAXIMUM INCOME LIMIT REQUIREMENTS FOR THE TAX CREDIT ARE BEING TEMPORARILY WAIVED.

Business income tax return changes. You cannot claim the additional child tax credit. 972 enter the amount from line 10 of the Child Tax Credit and Credit for Other Dependents Worksheet in the publication.

Idaho Child Tax Credit. There are some qualifying rules and income matters. If you are required to use the worksheet in Pub.

See the instructions for Forms 1040 and 1040-. It only applies to dependents who are younger than 17 as of the last day of the tax year. Otherwise enter the amount from line 8 of your Child Tax Credit and Credit for Other Dependents Worksheet.

The credit is worth up to 2000 per dependent for tax year 2020 but your income level determines exactly how much you can get. Previously you needed at least 2500 to. This is the Line 14 Worksheet used to determine the amount to be entered on line 14 of the Child Tax Credit and Credit for Other Dependents Worksheet.

Questions below apply to the Jan. Apply for Private Insurance Tax Credit Eligibility for a tax credit is based on the number of individuals included in your tax household and your annual taxable income. Subtract line 26 from line 21.

Total business income tax credits from Form 44 Part I line 10. Form 24 Form 40 or Form 43 You cant claim the grocery credit on more than one form. Idaho conforms to the IRC for tax year 2019.

Many families will soon get advance payments of the 2021 Child Tax Credit. Which form to use. Include Form 44.

Thats up to 7200 for twins This is on top of payments for any other qualified child dependents you claim. Income tax credit provided for employer contributions to college savings accounts. Nonresidents and part-year residents arent eligible.

Publication 972 contains a worksheet to help taxpayers figure their child tax credit. You must use a form to claim this credit refund. This Publication Is About the 2020 Tax Year.

To qualify for the child tax credit the child must be under age 17 as of December 31 must be your dependent who generally lives with you for more than half the year and must have the required social security number. This amount is then reduced by 5 of the amount that your AGI exceeds these levels. Complete the Earned Income Worksheet later in this publication 1040 and 1040-SR filers.

If you received less than you are eligible for based on your 2020 situation you can calculate the additional amount of credit to be included on your 2020 tax return. The Idaho Child Support Guidelines ICSG In Rule 6c6 of the Idaho Rules of Civil Procedure IRCP Section 1. The individual income tax rate has been reduced by 0475.

Schedule 2 line 5. The Child Tax Credit CTC is designed to give an income boost to the parents or guardians of children and other dependents. Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child.

Add lines 22 through 25. 31 2020 time period only. And Schedule 3 line 11 of your return if they apply to you.

The Child Support Guidelines are intended to give specific guidance for evaluating evidence in child support proceedings. The top rate for individuals is now 6925. 20 Zeilen Instructions for Schedule 8812 Additional Child Tax Credit 2020 01132021 Form 1040.

Computed amount from worksheet on page 10. Employers can get a tax credit for contributing to an employees IDeal Idaho 529 College Savings Program account. Amount of the child tax credit and the credit for other dependents that you may be able to claim when you file your tax return.

The credit amount on your tax return begins with the maximum that you are eligible for in 2020. The Recovery Rebate Credit Worksheet in the 2020 Form 1040 and Form 1040-SR instructions can also help determine if you are eligible for the credit and how much you can claim. If youre an Idaho resident who didnt make enough money in 2020 to file an income tax return youre still eligible to receive a grocery credit refund.

House Bill 380 Effective January 1 2020. Idaho has a new nonrefundable Idaho child tax credit of 205 for each qualifying child. Get details on Advance Child Tax Credit Payments in 2021.

If you dont normally file taxes because your.

Best Time For Wahweap Hoodoos Trail In Utah 2021 Best Season Summer Road Trip Road Trip Usa Places To Visit

July 15 Child Tax Credit You Can Opt Out Of Monthly Payment Ktvb Com

Best Budgeting Apps For 2021 The Ascent By Motley Fool Budgeting Money Management Instant Loans

Steam Education Wheel Infographic Science Technology Engineering Arts Mathemati Sponsored Science Technology Engineering Art Math Steam Education Education

Https Www Oregon Gov Dor Forms Formspubs Publication Or 40 Np 101 045 2019 Pdf

Https Www Afsa Org Sites Default Files 2019afsataxguide Pdf

What Is The Child Tax Credit Additional Child Tax Credit

Sometimes We All Need This Stay In Your Own Lane Doing Me Quotes Stop Caring Quotes Quotes To Live By

What Is The Child Tax Credit Additional Child Tax Credit

Pin By High End Affiliate Training On Affiliate Marketing Quotes Marketing Quotes Affiliate Marketing Marketing

Https Assets Ey Com Content Dam Ey Sites Ey Com En Us Topics Tax Ey Federal And State Form W 4 Compliance For 2021 Pdf Download

The Equal Credit Opportunity Act Ecoa Your Rights

July 15 Child Tax Credit You Can Opt Out Of Monthly Payment Ktvb Com

Our Plan To Pay Off 23 000 Of Debt In Only One Year Debt Payoff Debt Relief Programs Debt Relief

A Step By Step Guide To Filling Out 2020 S New W 4 Form

Shameless The Hidden Private School Tax Haven For The Rich National Observer Private School Tax Haven School

Https Www Afsa Org Sites Default Files 2019afsataxguide Pdf

Posting Komentar untuk "Idaho Child Tax Credit Worksheet 2020"