How Much Capital Gains Tax Do I Pay In Australia

Its not a separate tax just part of your income tax. There are no inheritance or estate taxes in Australia.

Capital Gains Tax Worksheet Excel Australia In 2021 Capital Gains Tax Capital Gain Spreadsheet Template

If you live in your property for at least six months once you purchase it you may be exempt from the capital gains tax.

How much capital gains tax do i pay in australia. If you ask me CGT is the last throw of the dice the tax department has to reduce your familys wealth. Although it is referred to as capital gains tax it is part of your income tax. Unless of course youre a business.

Capital gains tax occurs when you dispose of cryptocurrency whether that is a sale purchase trade or gift. Capital gains tax CGT for those who are new to this is the levy you pay on the capital gain made from the sale of that asset. If you sell the home for that amount then you dont have to pay capital gains taxes.

In short cryptocurrencies are subject to capital gains tax treatment as well as ordinary income depending on the circumstances of your crypto transactions. Retirees still have to pay Capital Gains Tax in Australia unless they qualify for another exemption. The Australian Tax Office has released official guidance on the tax treatment of cryptocurrencies.

Do you pay an inheritance tax in Australia. This changes if you had held the property for more than 12 months. This is the difference between what it cost you and what you get when you sell or dispose of it.

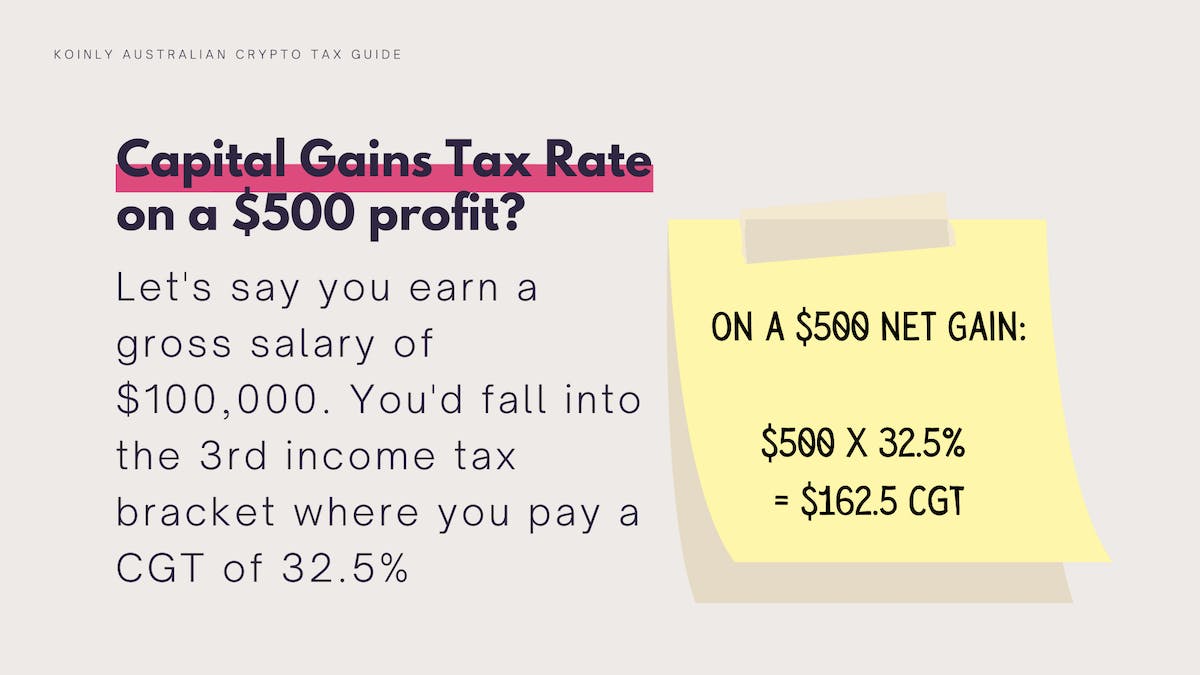

How do I calculate capital gains tax. The amount of Capital Gains Tax youll pay depends on factors including how long youve owned the asset what your marginal tax rate is and whether youve also made any capital losses. The Australian Tax Office ATO states.

A capital gain or loss is the difference between what you paid for an asset and what you sold it for less any fees incurred during the purchaseSo if you sell a property for more than you paid for it thats a capital gain. Your marginal tax rate is important because your capital gain will be added to your assessable income in your tax return for that financial year. Its a common myth that retirees pensioners or over 65s dont have to pay CGT but unfortunately there is no age limit to CGT in Australia.

If youre an individual the rate paid is the same as your income tax rate for that year. Capital gains tax CGT is the tax you pay on profits from selling assets such as property. Generally your tax will be based on your crypto income relative to the value of the coins in AUD.

Capital gain is the difference between how much you paid for an asset and how much you received when you sold it minus the costs incurred in selling it. There are a few strategies you can use to eliminate or minimise the capital gains tax you pay on a property. Introduced in Australia in 1985 the CGT means you have to pay a levy on that capital gain in the year you dispose of the asset.

CGT is the tax that you pay on any capital gain. If youre a company youre not entitled to any capital gains tax discount and youll pay 30 tax on any net capital gains. If you later sell the home for 350000 you only pay capital gains taxes on the 50000 difference between the sale price and your stepped-up basis.

If youve owned it for more than two years and used it as your primary residence you wouldnt pay any. If you own the asset for less than 12 months you will have to pay 100 of the capital gain at your income tax rate. You report capital gains and capital losses in your income tax return and pay tax on your capital gains.

Capital gains taxes are common globally but Australias implementation is considered one of the worlds most complex and the nuance in this regulation can have. Meanwhile self-managed super funds apply a 333 discount to their capital gain and pay 15 tax on the remainding amount. However you probably wont need to pay any tax in this instance and even if you do it wont be much.

As an Australian citizen or PR living in Australia you are liable to pay tax in Australia on your Capital Gains Worldwide. It is not a separate tax. Capital gains tax for business.

And if you have to pay capital gains tax on a property youre selling you may qualify for a 50 CGT discount. If your business sells an asset such as property you usually make a capital gain or loss. 17 hours agoHow Much Do I Pay.

An inheritance tax also known in other countries as a death tax or gift duty is a tax levied against people who receive assets from the estate of a deceased person. For SMSF the tax rate is 15 and the discount is 333 rather than 50 for individuals. In this case the 50 discount will apply reducing your taxable capital gain in half.

For example your tax. How do I avoid capital gains tax on property in Australia. This means your 100000 gain will be added to your taxable income and you will pay CGT of around 37000 according to the current tax rate of 37.

If you own the asset for longer than 12 months you will pay 50 of the capital gain. UK CGT is charged at 18 initially. However assets purchased before 20 September 1985 are exempt and exemptions apply for certain.

CGT was introduced in Australia in 1985 and applies to any asset youve acquired since that time unless specifically exempted. Capital gains tax CGT - applies to a cryptocurrency at the time it is disposed of. Youll be required to consider capital gains tax in the UK and in Australia.

What is capital gains tax CTG. Capital Gains Tax or CGT is one of those taxes no one really wants to pay. In Australia when investors sell shares and other listed securities for a price higher than they paid the profit or capital gain may be subject to a capital gains tax.

In that case youre not eligible for any discounts explained below and simply pay a 30 tax on your capital gains. This applies if youve owned the property longer than 12 months.

How To Avoid Or Cut Capital Gains Tax By Using Your Tax Free Allowance Getting An Isa And More Lovemoney Com

What S Your Tax Rate For Crypto Capital Gains

The Average Household Income In America Financial Samurai

Capital Gains Tax On Shares In Australia Explained Sharesight

The States With The Highest Capital Gains Tax Rates The Motley Fool

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

The Capital Gains Tax And Inflation Econofact

Crypto Tax Australia Crypto Capital Gains Obligations Pop Business

Do Retirees Pay Capital Gains Tax In Australia Wealthvisory

The Capital Gains Tax Property 6 Year Rule 1 Simple Rule To Avoid Cgt Duo Tax Quantity Surveyors

How To Minimise Capital Gains Tax Cgt

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Australian Cryptocurrency Tax Guide 2021 Koinly

Crypto Tax Australia Guide 2021 Cryptocurrency Tax Swyftx

Crypto Tax Australia Guide 2021 Cryptocurrency Tax Swyftx

A Complete Guide To Capital Gains Tax Cgt In Australia

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Posting Komentar untuk "How Much Capital Gains Tax Do I Pay In Australia"